Grunn Fundvia brings financial literacy to the average person. The website helps people access investment education without searching for too long on search engines for companies that offer investment teaching services. As Grunn Fundvia connects people, they get exposed to core investment topics and begin to understand the industry.

After registering on Grunn Fundvia, the education companies will show people the nitty-gritty of investment and help them develop the required skills.

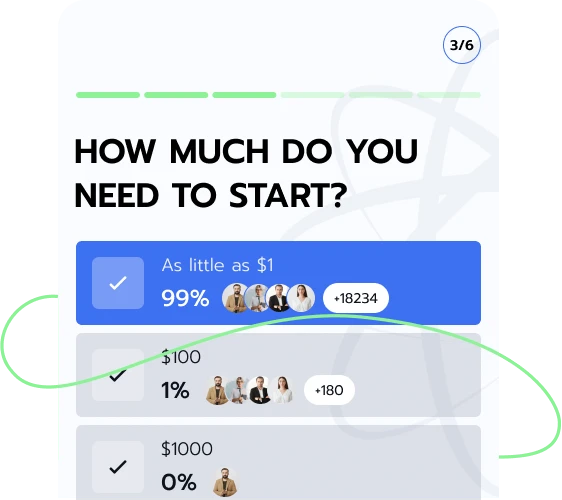

Finding investment education firms on Grunn Fundvia is simple and free. People should fill out the registration form with their full names, email addresses, and phone numbers to connect. Once connected, each firm will send their representatives to contact their connections to guide them on the next steps.

Grunn Fundvia understands how the absence of investment education may poorly affect people’s financial decisions. Hence, it connects people to investment education firms within a few minutes. With Grunn Fundvia, the connection process is fast, and people do not have to search rigorously or wait for long before connecting to an investment education firm. To connect, register on Grunn Fundvia.

The investment industry is filled with much information. People often have a hard time making heads or tails of it all.

To address this, Grunn Fundvia connects people directly to suitable educators Grunn Fundvia doesn’t charge a dime for this service. Register and connect with investment education firms for free on Grunn Fundvia.

Despite connecting millions to investment education companies, {Grunn Fundvia encourages more people to acquire investment education.

Grunn Fundvia enlightens people on the importance of investment education and shares snippets of investment content with potential learners to prepare them. Register on Grunn Fundvia to connect with investment teachers.

These investment education firms operate digitally and physically. They deliver their lessons through video conferencing tools and in their classrooms. Register on Grunn Fundvia to connect with an investment education firm.

Virtual investment education firms deliver their investment training online. This could be through the firms' websites or e-learning tools. Connect with an investment education firm by signing up on Grunn Fundvia.

These firms provide investment education services in a physical environment. Register on Grunn Fundvia to connect with an investment education firm and start learning.

People may buy assets to try for gains or invest in a business for a possible ownership share. Sometimes, an investor might choose an asset or have a portfolio. These could be bonds, stocks, cash or cash equivalents, or commodities.

Despite taking all cautionary steps, there are always risks. These may reduce the value of investments or even cause total loss. Some cautionary steps include diversification, asset allocation, and dollar-cost averaging. Learn more about investors by registering and connecting with investment education companies on Grunn Fundvia.

Investment education is providing people with investment knowledge through investment education firms. The firms create teaching syllabuses, quizzes, and grading systems used in the teaching process. As people learn, they understand how the economy works and how it affects businesses, finance, and investments. Grunn Fundvia discusses investment education focus below:

In classes, the teachers expatiate the different classes of investments, the characteristics, associated risks, and the strategies for risk mitigation. It’s common to begin with the three major asset types - stocks, bonds, and cash/cash equivalents. Learn more by signing up on Grunn Fundvia.

Investment teachers show students the different investment risks and narrow them down to asset-specific risks. Some risks include liquidity, concentration, foreign exchange, longevity, default, and credit risks. To learn more, register on Grunn Fundvia to connect with investment education firms.

Risk Mitigation Techniques

Students learn the different ways to reduce risk exposure. Sign up on Grunn Fundvia to learn more.

Investment vs Trading

Many people often use both terms interchangeably despite them being different. Investment teachers clarify the differences between both during their sessions. To know more, register on Grunn Fundvia.

Financial Markets

These are platforms where several asset types are exchanged (between buyers and sellers).

These include money, stock, cryptocurrency, bond, and forex markets. Financial markets are critical in a capitalist economy. When these markets fail, there could be economic recession or unemployment. Learn more by signing up on Grunn Fundvia.

Investment education firms teach people the different legal structures businesses take and their activities regarding obligations, expected tax, and capital raising. These include sole proprietorship, partnership, corporation, and limited liability company (LLC). Company owners often consider their goals, needs, and each structure's features before choosing a structure. Learn more by registering on Grunn Fundvia.

Sole proprietorship is the simplest to start among other business structures. The structure requires a single person to oversee the daily operations of a business. Setting up this structure demands lesser fees. Owners only have to pay for an operating license and business taxes.

A partnership is a company owned by two or more people. Thus, they are personally liable for the business’ obligations and debts. Both sole proprietorship and partnerships treat businesses and their owners as single entities. A corporation treats owners and businesses as separate entities.

Corporations could be a C or S-type. The former exists as standalone legal entities from their owners. S-corporations function as partnerships and may have up to 100 shareholders. An LLC combines the features of corporations and partnerships. Get more details from investment education companies by signing up on Grunn Fundvia.

Systems are required to guide the activities of an organization and the people in it (especially the board of directors). The focus is on accounting and disclosure, talent and enterprise risk management, and succession and strategic planning. Accounting and disclosure involve corporate governance responsibilities that support financial record keeping and approving public stakeholder reporting such as sustainability disclosures, 10Ks, and financial statements.

Talent management requires that the leaders in an organization know how to attract, retain, and improve human resources. Enterprise risk management involves identifying and mitigating an organization’s financial, reputational, strategic, and operational risks. Grunn Fundvia outlines other concepts related to corporate governance below:

Some of these are technology and data, climate change, geopolitical and economic uncertainty, and the great resignation. Technology is changing business operations, as stakeholders, customers, and employees are more concerned about privacy than before. To learn about other trends, register on Grunn Fundvia.

This represents the order of members based on authority level. The hierarchy starts with the shareholders, board of directors, chairperson, chief operating officer, chief executive officer, to chief financial officer. Register on Grunn Fundvia to learn more from investment teachers.

The board of directors determines the goals and objectives of an organization and ensures their implementation. It also dictates organizational policies and creates a compensation structure for all staff. The management team executes the organization’s objectives through daily activities. Sign up on Grunn Fundvia for more information.

Shareholder primacy is a governance and management ideology that considers leaders’ responsibilities as making decisions aligned with investors’ wants and needs. On the other hand, stakeholder primacy is a philosophy that considers stakeholders’ needs and outcomes in all operational and strategic decisions. Want to know more? Register on Grunn Fundvia.

Different factors cause financial risks. Political risks arise from poor leadership, terrible policies, or a change in governance. Liquidity risk occurs when investors cannot convert their assets to cash at a fair price.

Concentration risk stems from investing in only one asset or asset type. Investors often spread out their capital to mitigate this risk. Market risk causes prices to decline due to economic or market-related issues. Subtypes are currency, equity, and interest rates. Get more information by registering on Grunn Fundvia.

In mergers and acquisitions, the acquiring firm does its homework to assess the target company’s financial performance, assets, and capabilities. Types of due diligence are asset, financial, and administrative.

Asset due diligence involves reporting a target company’s assets and locations. These assets include real estate deeds, lease agreements for equipment, use permits, a schedule of major capital equipment purchases and sales in the past three to five years, and mortgages. Learn more about asset due diligence by signing up on Grunn Fundvia.

Financial due diligence thoroughly checks a company’s financials. These include the company’s projections, debtors, creditors, audited financial statements for the last three years, and capital expenditure plans. Register on Grunn Fundvia for more information on financial due diligence.

These are the policies an organization uses to manage its direction, allocation, and use of its financial resources. Before implementing financial controls, companies should detect anomalies in the available financial data, update data promptly, analyze all operational scenarios, and make projections. Get more knowledge about this by registering on Grunn Fundvia.

The idea is to identify and minimize errors while boosting business process efficiency. Register on Grunn Fundvia to learn more.

This is assessing all the parts of a decision and taking actions based on what may yield a suitable outcome. Sign up on Grunn Fundvia to learn more.

Value network is an organizational interaction where people create plans or sell products/services that favor the organization. Register on Grunn Fundvia for more details.

This is a business methodology for creating the relationship between business activities and the value network by evaluating the members of an organization. Want to learn more? Register on Grunn Fundvia.

These companies get products from primary sources and customize or improve them for reselling. Register on Grunn Fundvia for more.

Value proposition shows how a company’s products or services will be delivered differently and why consumers should buy.

Grunn Fundvia provides an uncommon opportunity for people to get personalized investment education.

Signing up on Grunn Fundvia exposes people to eye-opening information through their investment lessons. Get started by registering and connecting with investment education firms on Grunn Fundvia. Remember, it’s free!

| 🤖 Signup Expense | Completely free registration |

| 💰 Charges Applied | No hidden charges |

| 📋 Sign-Up Method | Straightforward, fast registration |

| 📊 Educational Topics | Focused learning in Cryptocurrency, Forex, and Investments |

| 🌎 Countries Available | Operational in most countries, excluding the USA |